“A new form of money that no one controls, yet everyone can use.”

🚀 Introduction: A Monetary Revolution

In 2008, an anonymous figure known as Satoshi Nakamoto released the Bitcoin White Paper, proposing something unprecedented:

A peer-to-peer electronic cash system — money without banks, governments, or any trusted third party.

This short but powerful document introduced a way to achieve digital scarcity—ensuring money cannot be counterfeited or spent twice—without relying on institutions. But to understand its significance, we first need to explore why previous digital money experiments failed.

🧩 The Core Problem: Trust in Institutions to Enforce Scarcity

Before Bitcoin, digital money required trusted intermediaries—banks, PayPal, or central servers—to guarantee:

- That you had enough funds

- That you weren’t spending the same money twice (double spending)

- That no one could manipulate the ledger

This model posed serious issues:

❌ Why Institutional Trust Fails in the Long Run

- Centralized control can lead to censorship and confiscation.

- Institutions may be hacked, corrupted, or politically pressured.

- Users must blindly trust opaque systems they cannot verify.

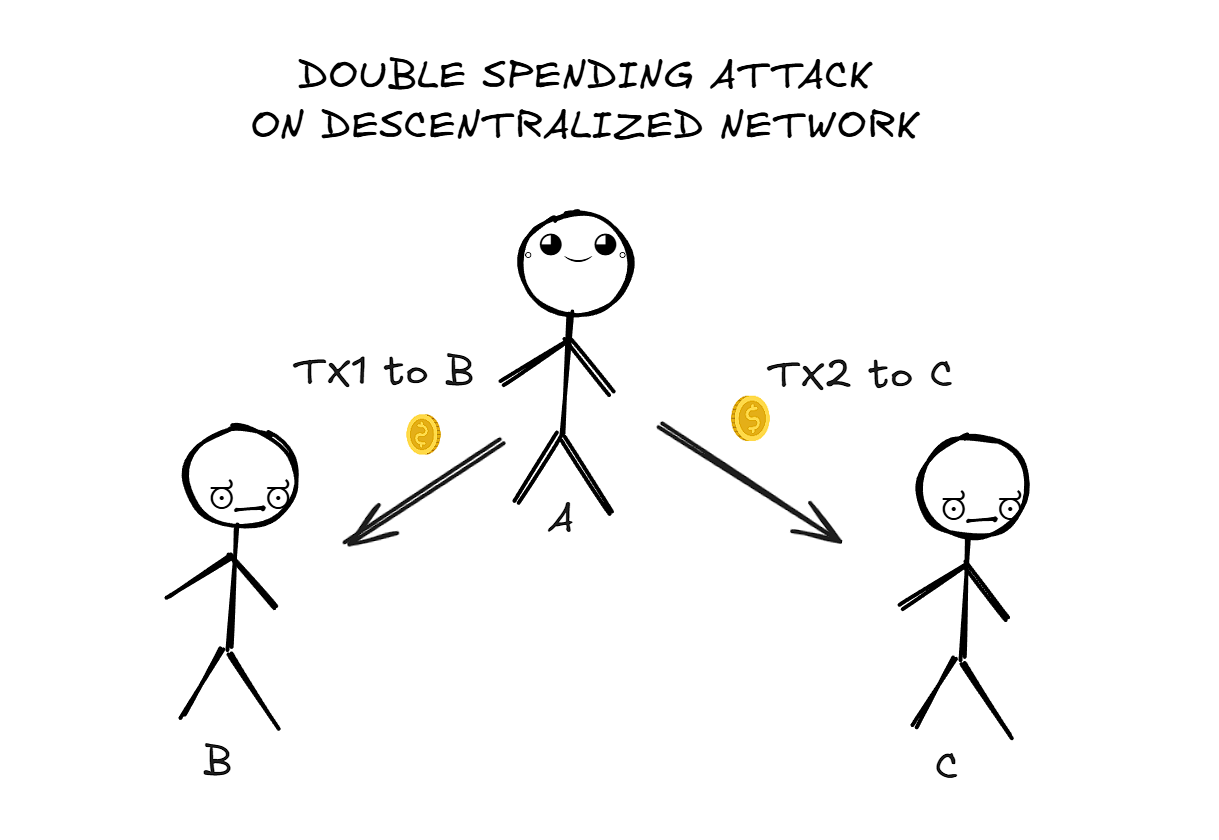

⚠️ The Double Spending Problem in a Decentralized Network

If there's no central referee, what's to stop someone from sending the same digital coin to two people at once?

This is the double spending problem—a fatal flaw in early digital money ideas.

🔎 Early Attempts Before Bitcoin

Bitcoin didn’t emerge in a vacuum. Several early projects laid the groundwork, each solving part of the puzzle but failing to solve everything.

🔹 Hashcash (Adam Back, 1997)

- Introduced Proof of Work to limit spam by requiring computational effort.

- Conceptual precursor to Bitcoin mining.

🔹 b-money (Wei Dai, 1998)

- Described a decentralized ledger and P2P payments.

- Lacked implementation and consensus mechanism.

These ideas were brilliant, but none could fully prevent double spending without relying on a central party.

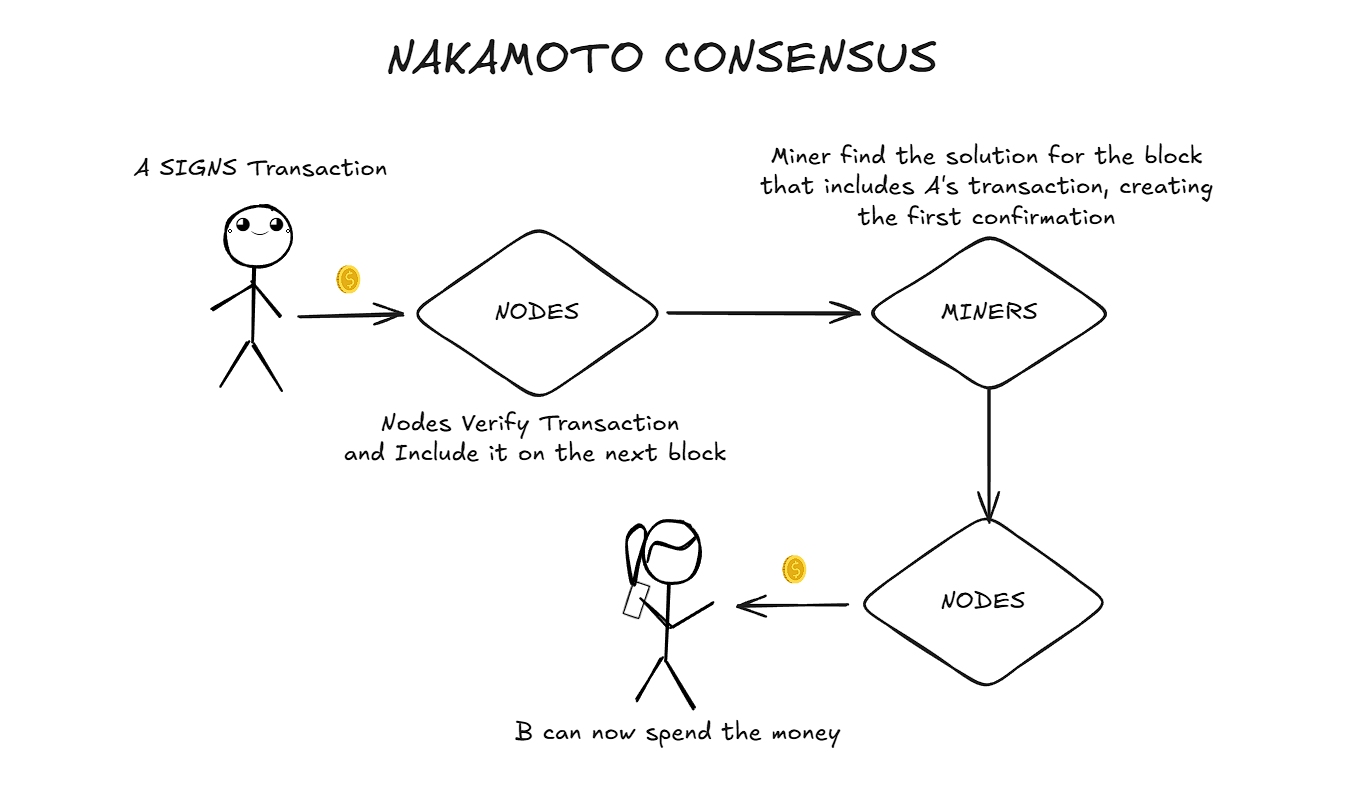

🧠 The Real Breakthrough: Nakamoto Consensus

Bitcoin's true innovation wasn't just the blockchain—it was Nakamoto Consensus, the first working system that combined:

- Proof of Work

- Decentralized peer-to-peer validation

- A transparent, immutable ledger

- Economic incentives for security

This solved double spending without trust.

🔄 How Nakamoto Consensus Works:

- A signs a transaction and broadcasts it.

- Nodes validate the transaction.

- Miners race to add it to the next block using Proof of Work.

- Once confirmed in a block, the transaction is immutable and public.

This process ensures no one can alter the past, and no transaction can be spent twice—without needing a central authority.

🔐 Bitcoin's Key Technologies

| 🔧 Technology | 📌 Purpose |

|---|---|

| Proof of Work | Secures the network, deters fraud |

| Blockchain | Public, append-only record of transactions |

| Public - Private Keys | Prove ownership and authorize payments |

| Peer-to-Peer Network | No intermediaries; open to all |

Together, these create a trustless system—everyone verifies everything, and no one needs permission to participate.

🌍 The Result: Bitcoin as the First Digitally Scarce, Trustless Asset

Bitcoin created the first verifiably scarce digital good:

- Supply limited to 21 million coins

- Rules enforced by software, not institutions

- Open to anyone, anywhere—unstoppable and censorship-resistant

📄 Summary – What the Bitcoin White Paper Achieved

✅ Solved double spending without institutional trust

✅ Enabled a decentralized, transparent financial system

✅ Introduced the first scarce digital money

✅ Sparked a global movement toward financial sovereignty